Stock Information

Stock Information

![]()

(As of September 30, 2025)

| Fiscal Year | April 1 to March 31 |

|---|---|

| Recorded shareholders on this date are entitled to year-end dividend payment. |

March 31 |

| Recorded shareholders on this date are entitled to interim dividend payment. |

September 30 |

| Ordinary Shareholders Meeting | June |

| Transfer Agent | Mitsubishi UFJ Trust and Banking Corporation |

| Stock Exchange Listings | Standard Market of Tokyo Stock Exchange |

| Securities Code | 7702 |

| ISIN Code | JP3386050003 |

| Authorized Number of Shares | 65,000,000 Shares |

| Number of Shares Issued | 24,733,466 Shares |

| Number of Shareholders | 9,385 |

| Public Notice | Public notices shall be made available electronically via the Company’s website in Japanese. In the event that public notice cannot be made electronically such as an accident etc, public notice shall instead be made in the Nihon Keizai Shimbun. |

Shareholders

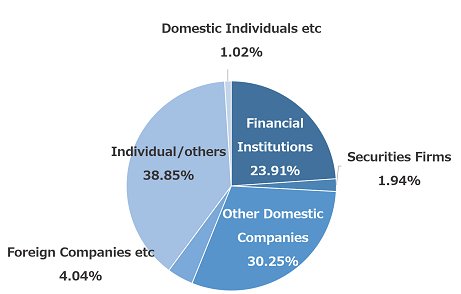

Distribution of Shareholders (As of September 30, 2025)

![]()

| Shareholders | Number of Shares holdings (in thousands of shares) |

Ratio of Shares holdings(%) |

|---|---|---|

| Financial Institutions | 5,813 | 23.50% |

| Securities Firms | 458 | 1.85% |

| Other Domestic Companies | 7,453 | 30.14% |

| Foreign Companies etc | 396 | 1.60% |

| Individual/others | 10,408 | 42.09% |

| Domestic Individuals etc | 202 | 0.82% |

Major Shareholders

(As of September 30, 2025)

![]()

| Name | Number of Shares holdings (in thousands of shares) |

Percent of Total Shares Issued(%) |

|---|---|---|

| Kaneka Corporation | 2,539 | 10.35 |

| The Master Trust Bank of Japan, Ltd. (Trust) |

2,314 | 9.43 |

| Tsuchiya Memorial Medical Foundation |

1,900 | 7.74 |

| Saeko Tsuchiya | 1,008 | 4.10 |

| Senjukai, Social Welfare Organization |

1,000 | 4.07 |

| The Hiroshima Bank Ltd. | 895 | 3.65 |

| JMS Kyoueikai | 726 | 2.95 |

| The Dai-Ichi Life Insurance Company, Ltd. |

645 | 2.63 |

| Osimo Sangyo Co., Ltd. | 571 | 2.32 |

| Custody Bank of Japan, Ltd. (Trust) | 510 | 2.08 |

*The shareholding ratio is calculated after deducting treasury stock (202,525 shares), and the fraction of odd-lot shares are rounded down.